Carbon Markets

As +190 countries have committed to enhancing their climate pledges under the Paris Agreement with the goal to limit global warming, there is an urgent need for innovative approaches and financial solutions from both, the public and private sectors, to leverage and scale-up financial flows, crowd-in the private sector, and help shift current development pathways towards a low-carbon, climate-resilient future.The use of mechanisms, such as emissions trading systems (ETS) or carbon taxes, are called “carbon pricing instruments”, and have been introduced and strengthened around the world as countries have adopted increasingly ambitious climate mitigation targets.

Indeed, ambitious carbon pricing can help close the gap between commitments and policy and keep the ambition of a 1.5°C increase in global average temperature according to statements made at the last Conference of the Parties (COP28) in Dubai.

According to the World Bank, there are currently 73 carbon pricing initiatives worldwide, covering around 23% of global GHG emissions. In 2022 alone, governments raised more than $95 billion from carbon pricing initiatives, 10% more than the previous year.

Carbon Markets encompass both, compliance and voluntary markets. Compliance carbon markets are those in which regulated entities obtain and surrender allowances or offsets in order to meet predetermined regulatory targets. Voluntary carbon markets include all carbon offsets transactions that are purchased to offset GHG emissions and reduce the carbon footprint of their operations, as well as fentities purchasing pre-compliance offsets before GHG emissions reductions are required by regulation, or with the intent to re-sell or retire to meet a carbon neutrality goal.

A carbon offset is defined as an instrument representing the reduction, avoidance or sequestration of one metric ton of carbon dioxide or greenhouse gas (GHG) equivalent.

Carbon markets are expanding worldwide, with increased cooperation among jurisdictions to align, harmonize and possibly link their markets to accelerate the delivery of long-term mitigation goals and successfully decarbonize their economies to achieve the ultimate goal of the Paris Agreement.

Where?

The European Union Emissions Trading System (EU-ETS) is the world's first major carbon market that was launched in 2005 and covers approximately 45% of the EU's GHG emissions from +11,000 installations in the power sector, manufacturing, industry, and airlines.Another initiative is the Cap-and-Trade program implemented in California, as a result from the California Global Warming Solutions Act of 2006. This is the first program in the U.S. that takes a comprehensive, long-term approach to address climate change, and requires California to reduce its GHG emissions to 1990 levels by 2020, to 40% below 1990 levels by 2030, and to 80% below 1990 levels by 2050 with the goal to improve the environment while maintaining a robust economy.

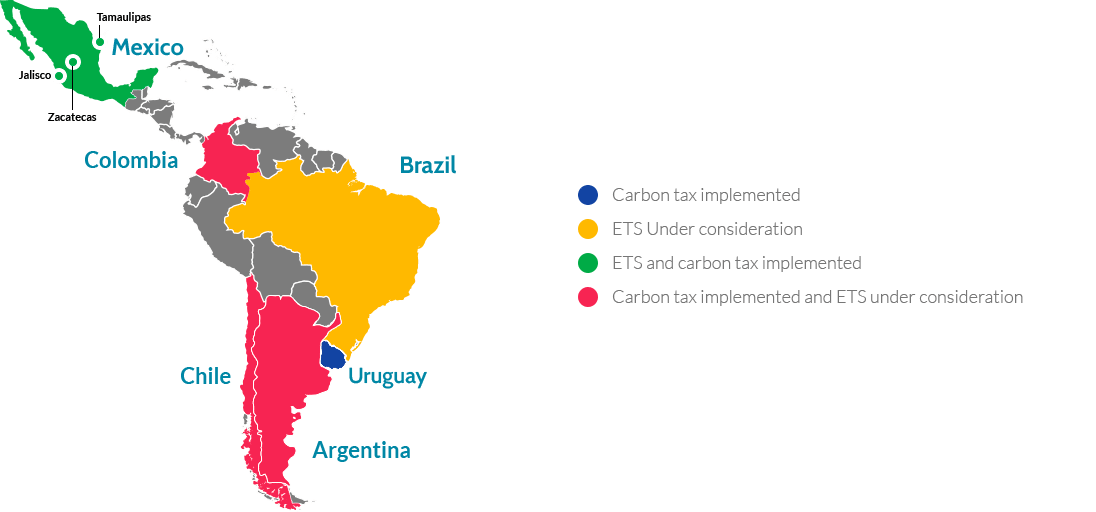

The first ETS in Latin America and the Caribbean (LAC), has been launched by Mexico in 2020 with its Emission Trading System (ETS) pilot program. Initially covering the power and industry sector (around 40% of national GHG emissions). Mexico’s General Law on Climate Change was amended to align with the goals of the Paris Agreement, and provides the legal mandate for this mitigation policy instrument. The Mexican ETS completed its pilot phase in 2022. In January 2023 the operational phase began. The ETS Bases, the regulatory structure with the rules of operation, are expected to be officially published during 2024.

In the LAC region, Brazil, Chile, and Colombia are in the process of discussing at the parliament level or structuring a compliance carbon market at the national level. Argentina is also considering implementing an Emission Trading System.

On the other hand, Argentina, Chile, Colombia, Mexico and Uruguay have national carbon taxes.

Why?

COP agreements on the operationalization of international carbon markets will help pave the way for greater collaboration and trade between countries. Ambition will be determined by new corporate commitments, increased demand in voluntary markets, and the new opportunities for forest offsets and nature-based solutions. Implementation of Article 6 is moving forward as more countries sign bilateral cooperation agreements, including LAC countries, and the first activities to generate authorized emissions reductions are developed. It is in the interest of key stakeholders and actors in the LAC region to understand and participate in this agenda and its related opportunities, to find ways to lead in this process, and considering the co-benefits, opportunities and challenges associated with the development of carbon markets.The Connectivity, Markets and Finance Division (IFD/CMF) of the Inter-American Development Bank (IDB) supports financial institutions in the LAC region, through the Climate Finance Fund and other bilateral resources, to develop relevant institutional capacities to design financing strategies to promote climate change mitigation and adaptation activities, and particularly to scale-up private sector investments in low carbon and climate-resilient initiatives. In particular, IFD/CMF is looking at identifying innovative ways to better mobilize and crowd-in private funds and environmental asset markets, including those related to carbon markets, biodiversity, green bonds.

Success Cases: Carbon Markets Webinar Series for LAC

The Brazil LAB, in its role as a multisectoral sustainable finance platform, believes it can contribute to the development of national carbon market initiatives in Brazil, and promote dialogue in the LAC region. To that end, it intends to promote awareness, knowledge sharing, and ideas that can facilitate and enhance participation of the various actors in the development of a carbon market in Brazil, as well as in the broader LAC region. In this context it is particularly important to discuss the status of carbon markets and the international climate negotiations on Article 6 of the Paris Agreement, but also related to key drivers for decarbonization and for carbon markets implementation at the government and corporate levels, as well as the economic opportunities that a low-carbon, climate-resilient transition can bring to Brazil and the LAC region. LAB Brazil, through the Green Finance Working Group, has published a document summarizing the main contents, highlights and quotes from the presentations made during a series of carbon market webinars held from March to August 2021. The activities were in collaboration with the IDB and GIZ as part of a regional effort for knowledge sharing and capacity building on carbon markets.

LAB Brazil, through the Green Finance Working Group, has published a document summarizing the main contents, highlights and quotes from the presentations made during a series of carbon market webinars held from March to August 2021. The activities were in collaboration with the IDB and GIZ as part of a regional effort for knowledge sharing and capacity building on carbon markets.

The webinar series on carbon markets, organized by the Financial Innovation Laboratory (LAB), serve as a venue for local and regional actors in Latin America and the Caribbean to discuss how to strengthen carbon markets to support greater ambition for GHG emission reduction targets set by the Paris Agreement. This series of events is part of a joint collaboration of the IDB with the GIZ and a regional effort to enhance knowledge sharing and build capacities on carbon markets in the LAC region.

IDB supporting carbon markets

The IDB has been working with several key national and international players in the sector to promote more information on the state and potential of the market, and boost good practices to encourage government and private participation in the construction of this sector. In this sense, the IDB is actively supporting various studies within the LAB on the regulatory framework necessary to promote legal security and the business environment for the voluntary and regulated carbon markets; supporting the pilot of incentive programs to boost green investments that can benefit from accreditation and emission credits; assisting schemes and ecosystems that facilitate the monitoring and evaluation of emission reductions, and practices that promote greater transparency in the markets. We will also produce tailored publications on these themes in 2021 and 2022, in addition to supporting the dialogue in the Lab to make recommendations that can promote a better market ecosystem.Carbon Markets Related Publications:

• Legal Analysis of Possible Regulatory Models

• Studies on the carbon market in Brazil (Resume)

• Analysis of Permission Allocation

• Analysis of the Potential Dimensioning of the Market-Case Study on the State of São Paulo, Brazil

Recursos

Mantenha-se informado sobre o Financiamento Verde

Mantenha-se informado sobre o Financiamento Verde