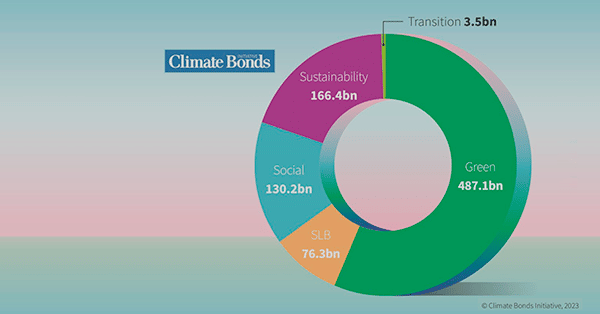

Climate Bonds Initiative (CBI) has published a snapshot on the 2022 sustainable bond market and the drivers for sustainable finance in 2023. The issuance of green, social, sustainable, sustainability-linked and transition (GSS+) bonds totalized 863.4 billion dollars in 2022, maintaining its market share despite a difficult year for fixed income markets. Green bond issuance represented 56% of the total GSS+ market, followed by sustainability bonds (19%), social bonds (15%), sustainability-linked bonds (SLB) (9%) and transition bonds (0.4%).

According to the article, the 5 developments that should not be missed for 2023 are:

1. Increased investments in resilience: Providing the market with clear definitions and sets of rules would broaden green investments to include those that build resilience. This expansion will include investments that address the underlying vulnerability of people and ecosystems to climate change.

2. Rigour in the SLB Market: CBI’s forthcoming expansion of its Standards and Certification Scheme to SLB in early 2023 will provide rigour in the market and signal to potential investors and regulators SLBs that comply with the best practices against an internationally recognized standard.

3. Growing Government support for green industry: A trend seen among global policymakers is that climate considerations should take center stage in the recoveries from the pain of pandemic, the instability of soaring inflation, to the financial sting being felt over energy security.

4. Transition Tipping Point: 2023 is expected to bring a transition tipping point, a necessary time to green hard-to-reduce sectors and align heavy industry with global efforts toward net zero.

5. Sovereign issuance: As of the end of 2022, CBI registered GSS+ bonds from 43 sovereigns with combined volumes of 323.7 billion dollars. This momentum is expected to continue through 2023 as Israel and India have come to the market with green bonds.

Stay updated on the latest trends of Green Finance

Stay updated on the latest trends of Green Finance